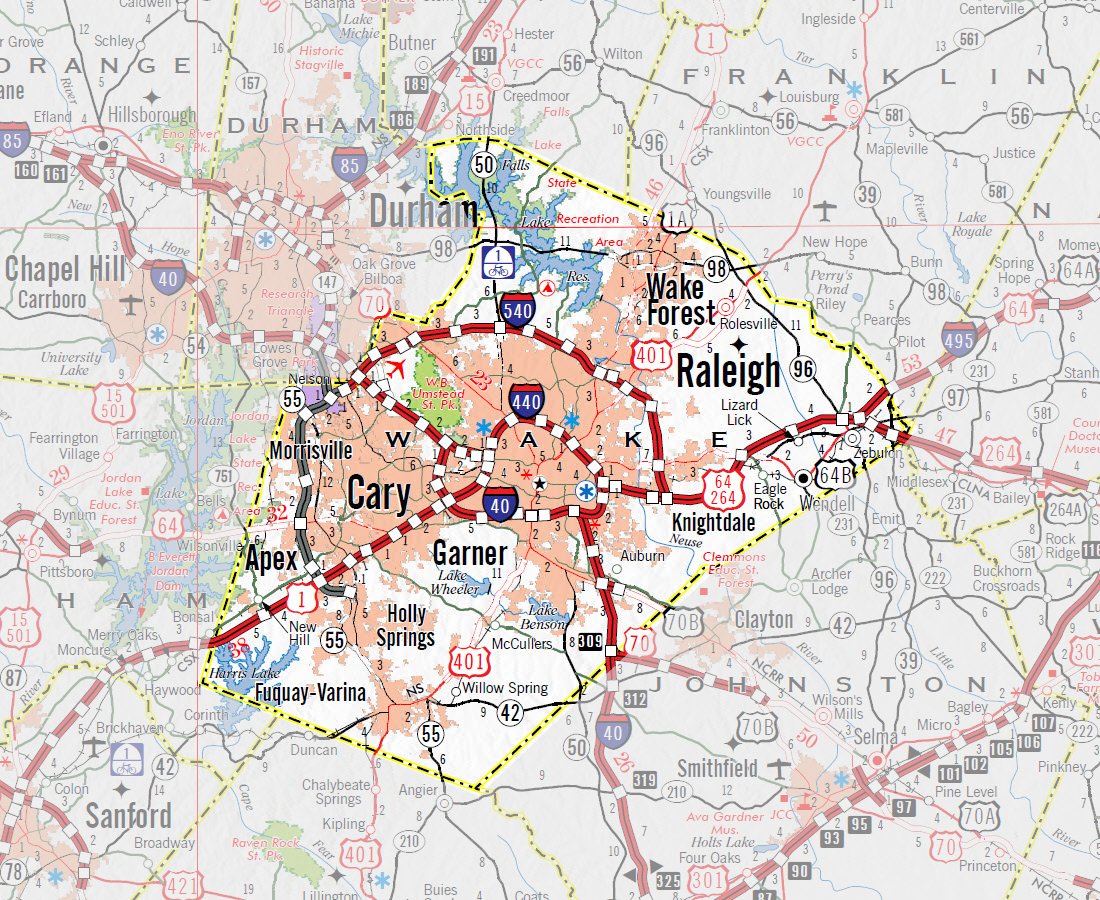

Wake County Nc Property Maps – Wake County’s property tax rate for 2024 is .657 cents per $100 of property value, according to the country. The revenue neutral rate at the new appraisals would be .4643 cents per $100 of value. . The statistics in this graph were aggregated using active listing inventories on Point2. Since there can be technical lags in the updating processes, we cannot guarantee the timeliness and accuracy of .

Wake County Nc Property Maps

Source : www.lib.ncsu.edu

iMAPS Information | Wake County Government

Source : www.wake.gov

Zoning | Town of Wake Forest, NC

Source : www.wakeforestnc.gov

Wake County GIS Data | NC State University Libraries

Source : www.lib.ncsu.edu

GIS | Town of Wake Forest, NC

Source : www.wakeforestnc.gov

Geographic Information Services (GIS) | Wake County Government

Source : www.wake.gov

Wake Forest Map | Town of Wake Forest, NC

Source : www.wakeforestnc.gov

Real Estate | Wake County Government

Source : www.wake.gov

Historic Districts | Town of Wake Forest, NC

Source : www.wakeforestnc.gov

iMAPS Information | Wake County Government

Source : www.wake.gov

Wake County Nc Property Maps County GIS Data: GIS: NCSU Libraries: Some Wake County property owners are experiencing serious sticker shock at the mailbox. New assessments are being sent out this week and some people are reporting their home value soared as high . For nearly five years, Wake County residents and visitors have watched and operates toll roads in the state. Drivers with an NC Quick Pass transponder in their cars will pay $8.01 to drive .